Are you struggling to acquire a loan but feel lost by the process? Don't worry. A qualified loan consultant can be your advisor through this challenging journey.

They possess the expertise to analyze your financial situation and recommend loans that match your requirements. With a dedicated loan consultant by your support, you can maneuver the banking world with certainty.

Finding the perfect loan consultant is vital to your success.

Start by investigating local choices. Read testimonials from other clients and evaluate the specialist's background. Schedule appointments with a few suitable consultants to chat your needs and assess their strategy.

In the end, choose a loan consultant who you feel comfortable with and who concisely outlines your options. With the right direction, you can realize your financial aspirations.

Finding Top Financial Consultants for Personal Loans: Get Expert Advice

Navigating the world of personal loans can seem overwhelming. With countless options and complexities, it's easy to become lost in a sea of figures. That's where top financial consultants come in, providing invaluable support tailored to your unique needs. These experts possess the knowledge and experience to help you obtain the ideal loan terms, reducing interest rates and maximizing your financial stability.

Employing a qualified financial consultant can prove a sound decision when it comes to personal loans. They can assess your financial situation, recommend suitable loan products, and assist you through the entire procedure.

- Think about a consultant's qualifications.

- Look for recommendations from trusted sources.

- Book discussions to gauge their fit with your needs.

Enhance Your CIBIL Score Fast: Proven Strategies and Tips

Achieving a stellar CIBIL score can unlock financial opportunities yet open doors to better loan terms with lower interest rates. While it takes time towards build a strong credit history, there are actionable strategies you can implement right now to accelerate the process. By implementing these proven tips, you can significantly improve your CIBIL score so that pave the way for a brighter financial future.

- Make your bills on time, every time.

- Keep a low credit utilization ratio.

- Monitor your credit report regularly and identify any errors.

- Limit the number of new credit applications you submit.

- Build a healthy mix of credit types.

Remember, consistency is key when it comes to building good credit. By implementing these strategies diligently over, you'll be well on your way to achieving a high CIBIL score and unlocks greater financial freedom.

Finding Personal Loan Advisors in India: Helping You Secure Your Finances

Personal loans can be a valuable tool for individuals facing financial obstacles in India. However, the journey of securing a loan can sometimes feel daunting. This is where personal loan experts come into play. They act as trusted helpers, providing specific advice to help you explore the world of personal loans and find the suitable option for your needs.

A competent personal loan advisor will begin by assessing your financial situation, comprising your income, expenses, and credit score. They will compare insurance policies with consultant then recommend loan products from different lenders that suit your requirements.

Additionally, personal loan advisors can support you with the procedure itself, ensuring that all documentation are accurate. They can also bargain on your behalf to attain the most favorable interest rates and loan terms.

By collaborating with a personal loan advisor, you can enhance your chances of receiving a personal loan that is manageable. This can facilitate you to realize your financial objectives and upgrade your overall financial well-being.

Charting the Path to Personal Loans: Expert Guidance is Key

Securing a personal loan can feel overwhelming, especially with the multitude of lenders and loan options available. That's where an expert personal loan consultant can provide invaluable support. A seasoned professional will carefully assess your personal situation, analyze your needs, and recommend the most suitable loan solutions.

Their role goes beyond simply matching you with a lender; this guidance encompasses bargaining for favorable interest rates, exploring potential discounts, and confirming that the loan terms align with your strategic financial goals.

- Choosing a reputable personal loan consultant must involve researching their experience, qualifications, and client testimonials.

- Schedule consultations with multiple consultants to compare their approaches and identify the best fit for your needs.

An expert personal loan consultant can be your trusted guide through this complex financial process, facilitating you to make informed decisions and achieve your personal goals with assurance.

Unlocking Your Financial Potential: A Guide to Personal Loans

Personal loans can provide a valuable tool for achieving your financial goals. Whether you're looking to consolidate debts, make a major acquisition, or simply gain financial flexibility, personal loans provide a efficient process for securing the funds you need.

To unlock your financial potential with a personal loan, it's crucial to carefully consider your needs and compare different lenders.

Understanding interest rates, repayment terms, and any associated fees plays a critical role in making an informed decision that aligns with your financial situation.

By diligently planning and comparing your options, you can find a personal loan that empowers you to manage effectively your finances and achieve your goals.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Andrea Barber Then & Now!

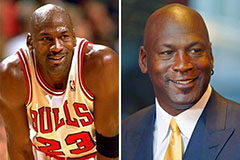

Andrea Barber Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now!